What is AP Automation and Does It Work On Its Own?

While this article spells out many details about AP Automation, and we highly recommend you read about all of them, here is a quick list of the topics and questions this article explores:

- AP Automation Case Study

- What is AP Automation?

- How Do AP Departments Operate?

- What are the Hidden Costs of AP Automation?

- Does AP Automation have an ROI?

- What are the Benefits of AP Automation?

- Does AP Automation Pay? If so, under what circumstances?

AP Automation Case Study

One of the largest commercial office Real Estate Investment Trusts (REIT), headquartered in Arizona, had implemented an outsourced, web-based Accounts Payable (AP) imaging, Optical Character Recognition (OCR) and workflow solution to drive efficiency through the AP process.

The result: The AP department had half of the productivity of a typical AP department and incurred one of the highest costs to process an invoice we have ever seen.

Their aim to automate AP clearly had a negative Return on Investment (ROI). This result is, in fact, not at all unusual; a negative ROI is the typical outcome of an AP automation project. How could this happen when automation is supposed to improve efficiency?

What Is AP Automation? A Closer Look at the AP Process and Automation

The AP process would seem like an ideal candidate for automation. It involves receiving paper invoices from vendors; coding them; routing them for approval or performing a match between the invoice, purchase order and receipt; entering the invoice data into the accounting system; and performing disbursement of funds through checks, wires or ACH payments.

There are a myriad of vendors selling AP automation solutions that scan paper invoices and turn them into electronic images, OCR tools that “read” the invoice and populate the data from the invoice into a system, and workflow tools that allow the electronic images and data to be routed electronically for approval and/or perform a match. Some or all of these components may be implemented in a solution.

It’s therefore logical to conclude that these tools, once implemented, would yield a highly positive ROI, right?

In reviewing the AP process at well over 200 companies in a variety of industries, we have found that the answer is almost always the opposite – most pure AP automation projects fail.

Why? The answer can be found in how AP departments actually operate.

How do AP Departments Operate?

The assumption that most of the work in an AP department is simply data entry leads people to think that automation will eliminate most of the effort – but nothing could be farther from the truth.

In our review of well over 200 AP departments, we see that they typically perform the following functions and incur these average percentages of time and cost (since the cost is mostly personnel and related overhead).

Note that these figures may vary based on the industry and the individual company, but these figures are accurate for most service and manufacturing companies apart from retailers:

- Invoice receipt – 15% – This involves receiving the invoice either on paper or electronically, opening the mail and getting it ready for processing

- Data entry and/or invoice matching – 10% to 20% – This involves entering the invoice (in the case of a Non-PO invoice) or performing a three-way match of the invoice, PO and receipt (in the case of a PO invoice) into the accounting system.The percentage of effort is generally higher if the company uses a higher percentage of POs since these require matching which in turn requires documenting exceptions and routing them for resolution.

- General ledger coding, problem resolution, sales/use tax compliance, vendor maintenance, accruals/other projects and customer service – 60% to 70% – This involves determining the general ledger coding for an invoice, resolving any exceptions on an invoice such as a discrepancy between the PO price and invoice price, adding and maintaining vendors, performing customer service such as dealing with phone calls from vendors and other managers in the company, and performing monthly, quarterly or annual processes such as monthly accruals, 1099’s, etc.

- Disbursement – 5% – This involves paying vendors according to terms in the appropriate format (check, wire, ACH), dealing with problems related to disbursement (stopped checks), escheatment, and so on

What Are the Hidden Costs of Accounts Payable Automation (AP Automation?)

AP automation also adds a degree of overhead to the AP process that is not insignificant in the following areas:

- Scanning invoice documents and routing invoices for approval or exception resolution is time consuming (in a paper process there is no need to scan documents and they arrive in the AP department generally approved and coded)

- Performing data entry into a typical browser-based AP automation system usually takes more time because, unlike accounting systems, these systems are not optimized for high speed data entry

- Maintaining the system with user IDs, passwords, security setup, approval matrices (who approves which invoices and at what dollar levels), manager roles, etc.; not to mention handling an excessive number of phone calls into the AP department that now come from people who forgot their passwords

- Managers placing more requests upon the AP department for information, not fewer due to availability of AP information and document images

The bottom line? The overhead involved typically erases all of the saved effort in data entry by a factor of two or more!

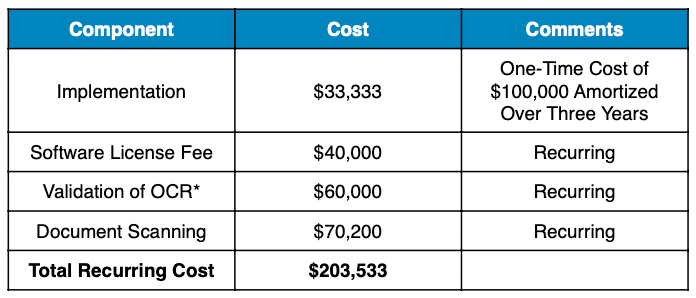

Let’s look at another example. One of our clients implemented an AP automation solution before they engaged us. Their costs were as follows:

*One of the common myths purported by companies selling OCR tools (in which software turns the letters on the page into actual text to be fed into the computer) is that the system will accurately “read” the invoice more than 98% or 99% of the time.

But if you think about it, if there is a 1% or 2% error rate (or even a fraction of that), you will need to have a human being validate the OCR results to limit the number of errors. While it seems like a tiny error rate, it could be a calamity if the amount paid on one invoice is incorrect, especially if it’s for a large dollar amount. Some effort therefore has to remain to validate the OCR on invoices.

Does AP Automation have an ROI?

If we calculate a Return on Investment for this AP Automation project, it’s as follows:

- Annualized Cost of AP Automation: $203,533

- Savings in Headcount (1.7 FTE’s): $88,400

- Negative Net Savings: ($115,133) or -57%

This law firm has a negative 57% ROI on their AP automation investment. Again, this is a typical scenario and does not include the system overhead required that is mentioned above, nor does it include internal IT resources required to “train” the OCR system to read invoices which can be 1/2 of a person or more.

What Are the Benefits of AP Automation?

- Transparency of the process to all process users including at the transaction and overall process level

- Electronic routing of invoices

- Improved compliance with process rules and policies/procedures

- Improved accuracy

Top Companies Choose IQ BackOffice

Does AP Automation Pay? If so, under what circumstances?

AP automation does pay – under certain circumstances.

What works is the implementation of best practice processes through reengineering of the Accounts Payable process. Executed properly, reengineering takes out work steps and improves management controls, internal controls, process quality and timeliness.

That’s crucial because in Accounts Payable, improved controls and quality lead to fewer errors. Fewer errors dramatically reduce the key source of effort which is problem resolution and customer service.

Reengineering of the process has always achieved far greater improvements compared to automation…but it has to be done correctly.

One caveat: A reengineering initiative can have a negative ROI if the volume of invoices processed is not large enough to result in enough savings to cover the costs of the reengineering efforts, which usually requires expensive consultants.

From the clients we have researched, a company will have a positive ROI on its efforts if it has an invoice volume of at least 50,000 invoices per month. This unfortunately leaves out all but the largest companies.

Another caveat: Implementing AP automation on an AP process that has not been properly reengineered simply makes a poor process go faster. It’s what’s known as “paving the cowpath”– paving over a meandering, wasteful, ineffective process.

The solution is to outsource the process to a service provider that has already invested in creating reengineered, best practice processes enabled by AP automation technology.

Savvy companies today outsource payroll and also other non-core processes to an external provider. This allows a company to “plug in” to existing processes without incurring the expense of setting up processes and technology.

For a non-core process such as AP, clearly automation alone doesn’t pay. Turning to a reliable and proven outsourcer, especially one that has processed millions of transactions every year and has model processes and technology already in place, could be your best bet.

AP Automation - How Can IQ BackOffice Help?

IQ BackOffice’s solutions enable companies around the globe to automate, reengineer and streamline the complex financial processes they manage.

Whether its Accounts Payable, Accounts Receivable, Payroll or other processes, 99.97% quality and up to 70% cost savings is standard.

Let IQ BackOffice take your traditional paper-based processes into the modern era by digitizing, streamlining, and reengineering them while gaining best practices and tight controls.

By reengineering client business processes to take advantage of best practices and SSAE 18 SOC Type II-certified standards, we help our clients achieve greater efficiency and flexibility, and improve process quality and real-time access to vital financial information for more informed decision making.

Our proprietary, web- based Archimedes system integrates with, sits on top of and leverages clients’ existing accounting and other systems to automate their financial and human resources processes.

Our software ensures clients’ business rules are followed consistently and accurately, and lets clients review and approve transactions from any web-enabled device.

IQ BackOffice works with leading global companies which include the world’s largest steel manufacturer, the largest technology and entertainment conglomerate, large retailers and restaurant chains across thousands of stores and e-commerce sites. Other major clients include distribution, energy, healthcare, real estate, and financial services companies.

IQ BackOffice has offices in Los Angeles, California; Manila, Philippines and Chennai, India. IQ BackOffice processes over $18 Billion of financial transactions annually, with 99.97% quality.

Download our AP Automation White Paper here.

Learn more about our AP Outsourcing service and our full range of outsourcing services.

Read More about this topic:

How Much Does Accounts Payable Automation Cost?

Top 7 Benefits of Accounting Automation and Outsourcing

Accounts Payable Outsourcing Transition – Top 5 Mistakes Not to Make

Accounting Outsourcing – Top 5 Rookie Mistakes

Outsourcing Accounting Processes – Does It Actually Save Money?